Loyang Valley En Bloc 2025

Right Timing & High Hope

Resort-Style Changi Condo Slashes Reserve Price by $100M as Owners Bank on Infrastructure Boom and Market Recovery

After two failed attempts, the sprawling Loyang Valley condominium is rolling the dice once more on a collective sale that could transform the lives of 362 unit owners.

This time, however, the stakes are different. The reserve price has been slashed to $880 million, down from the ambitious $980 million tag that scared away developers in 2022.

Set against the backdrop of Changi’s evolving landscape, this third attempt comes at a pivotal moment.

The confirmed Cross Island Line MRT station, potential relaxation of airport height restrictions, and improving market conditions have created what industry experts believe could be the perfect storm for success.

For long-time residents like the retiree who’s called Loyang Valley home since 1985, this isn’t just about money—it’s about timing, legacy, and the chance to finally cash in on four decades of memories built on what was once considered the outskirts of Singapore.

The Numbers Game: What $880 Million Means for Owners

The mathematics of this collective sale tell a compelling story of adjusted expectations meeting market reality.

At the reduced reserve price of $880 million, individual unit owners stand to receive substantial payouts that reflect both the property’s prime location and current market conditions.

The smallest two-bedroom unit, spanning 1,001 square feet, would net its owner approximately $1.67 million. Meanwhile, those fortunate enough to own the largest four-bedroom units could see returns of around $3.9 million.

These figures represent a significant windfall for many owners, particularly those who purchased their units decades ago at a fraction of current values.

The 362-unit development sits on an impressive 840,648 square feet of land, making it one of the larger collective sale opportunities in recent years.

With 56 years remaining on its 99-year lease, the property offers developers a substantial runway for long-term planning and returns.

Strategic Repositioning: Learning from Past Failures

This third attempt represents a masterclass in strategic repositioning.

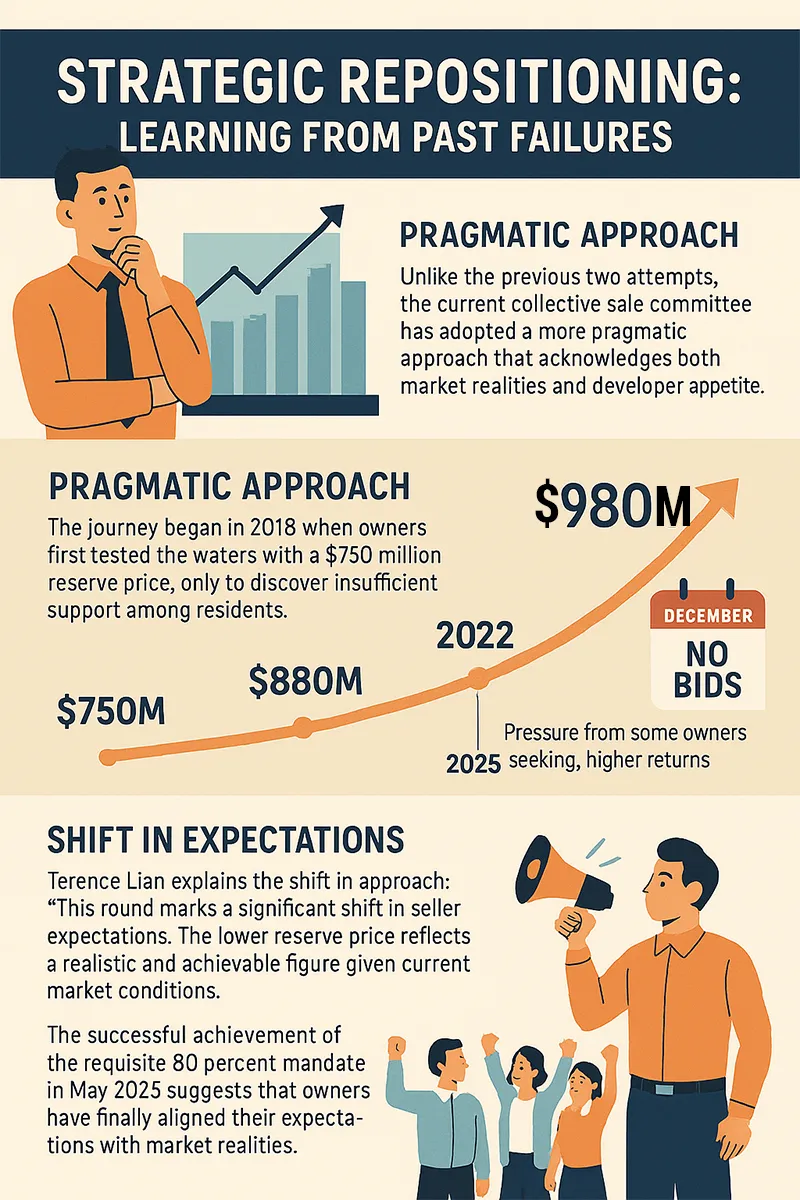

Unlike the previous two attempts, the current collective sale committee has adopted a more pragmatic approach that acknowledges both market realities and developer appetite.

The journey began in 2018 when owners first tested the waters with a $750 million reserve price, only to discover insufficient support among residents.

The 2022 attempt showed more promise, initially proposing the same $880 million figure that’s being used today.

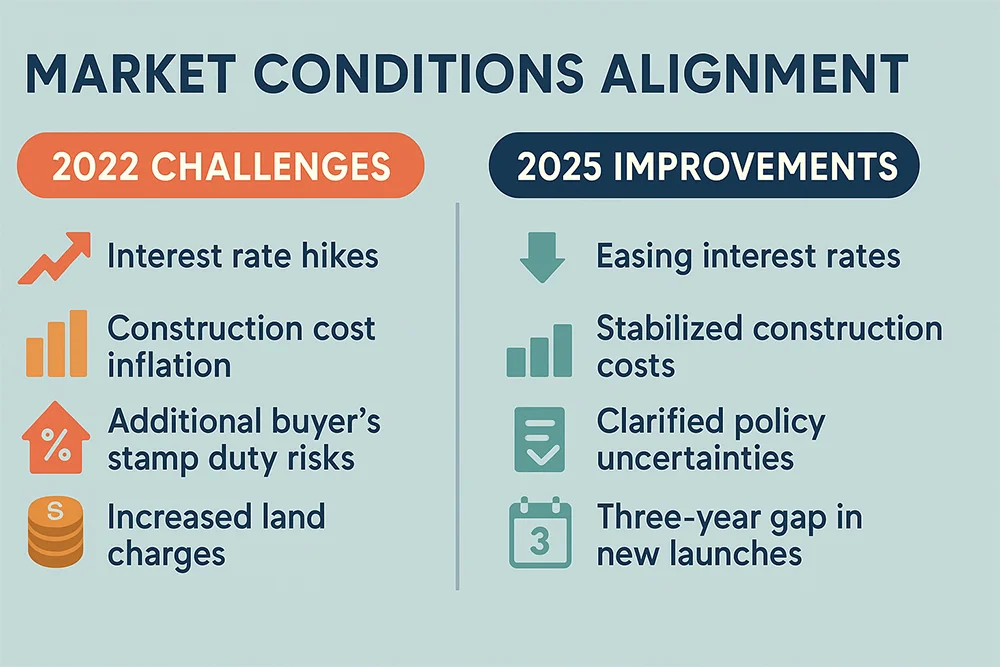

However, pressure from some owners seeking higher returns pushed the reserve price to $980 million—a decision that ultimately backfired when no bids materialized by the December 15 closing date.

Terence Lian, head of investment sales for appointed marketing agent Huttons Asia, explains the shift in approach: “This round marks a significant shift in seller expectations. The lower reserve price reflects a realistic and achievable figure given current market conditions.”

The successful achievement of the requisite 80 percent mandate in May 2025 suggests that owners have finally aligned their expectations with market realities.

This consensus-building process has been crucial, as collective sales require not just market timing but also internal harmony among diverse stakeholder groups.