En bloc Sales Process Singapore 2024

Complete Step By Step Guide

Welcome to your comprehensive resource on the En Bloc Sale Process in Singapore – your all-in-one guide to navigating the complexities of collective sales in one of the world’s most vibrant real estate markets.

Whether you’re a property owner considering a sale, a potential buyer, or just keen to understand more about how en bloc sales work in Singapore, this page is designed to provide you with all the essential information and guidance you need.

En bloc sales, a pivotal mechanism for urban redevelopment in Singapore, involve the collective sale of multiple property units to a developer for the purpose of redevelopment.

This process not only catalyzes the transformation of aging properties into modern developments but also often results in significant financial returns for the sellers.

Navigating through this process requires a clear understanding of legal procedures, financial considerations, and strategic planning.

Here, you’ll find detailed insights into each step of the en bloc process, from the initial stages of forming a collective sale committee to understanding the legal requisites, garnering the required owner consents, managing public tenders, and finally, executing the sale.

Our goal is to equip you with the knowledge to make informed decisions whether you’re directly involved in an en bloc sale or are exploring investment opportunities.

Total Collective Sales

From 2017 to 2025

S$29 Billion Est

Most Asked Questions

Stages of an En Bloc Sales Process

Step 1: Initiation of an Extraordinary General Meeting (EOGM)

The first thing owners of housing units do when they want to sell collectively is to find neighbours who are likely to agree with them, and then float the idea to them.

Once the number of sellers willing to sell reaches a certain threshold that is determined by voting, they set a date and meet with a view to setting up a collective sales committee (CSC).

If the idea is to sell a whole housing block as a unit, the threshold is 20% of the block ownership in terms of share value.

In short, the properties the neighbours willing to sell collectively own must constitute 20% of all the shares held by the total number of owners together.

Otherwise, the group may go by subsidiary proprietorship, in which case the consenting owners must constitute 25% of total proprietorship.

If there had been an earlier attempt to sell en bloc that failed, the threshold of unit owners who can formally initiate the process is 50% whether it is by shareholding or by subsidiary proprietorship.

It is worth noting that whenever property owners issue a collective sales tender and the sale does not go through, they are obligated to stay for a minimum of 2-yrs before they can initiate another collective sales bid.

Although the percentage of ownership is not very high with regards to having the authority to discuss the possibility of selling en bloc, nothing formal can be done until unit owners with 80% shareholding or strata area ownership consent to the sale.

The threshold of 80% relates to buildings that are more than 10-yrs old, but the threshold for those less than 10yrs is higher, at 90%.

As such, often the first EOGM is consumed convincing more members to give consent to the sale, unless the few initiators of the discussion manage to convince the bulk of the people before the scheduled date.

To ensure a smooth collective sales process, owners interested in selling their property en bloc must adhere to the Strata Titles Act, Section 84A, which stipulates the threshold for consenting property owners.

Nevertheless, there are cases where all owners speak with one voice and are eager to sell. In such cases where there is 100% consent, the sales process takes a very short time from the beginning to the end.

If there is ever controversy as to how old a development officially is, especially for the sake of consenting threshold, the date considered to be the property’s construction date is the date when its temporary occupation permit (TOP) was issued.

In a case where there was no TOP issued, the age of the building is counted from the date the Certificate of Statutory Completion (CSC) was issued.

ONCE COLLECTIVE SALE COMMITTEE (CSC) IS FORMED

- CSC speaks to a number of marketing consultants for their presentations and proposals

- CSC speaks to a few lawyers for their presentations and proposals

And recommend the appointed/ proposed consultant and solicitor to the rest of the owners in the next EOGM.

Step 2: Call for a 2nd EOGM

Appointment / Ratification of relevant professionals

The recommended marketing consultant and solicitor are appointed and ratified in this EOGM.

For a group of individuals to sell their valuable properties together in a smooth manner, it is necessary to hand over the technical work to a team of professionals.

These experts include property consultants, valuers and even lawyers. Sometimes such appointments may not be accomplished on the spot during the second EOGM, and it is common practice to delegate that work to the CSC.

In cases where there is 100% consent to sell from the beginning, the appointment of these professionals can even be done in the very first EOGM.

It is during the 2nd EOGM that the property owners discuss what they deem the best way to distribute the yields from their housing units once a buyer has been found.

Although every unit owner is entitled to contribute to the debate, usually it happens that the people who are more knowledgeable about matters of sales and appropriation are in the sales committee, and so in reality the CSC guides the majority on most of the important issues.

However, because of the technicality of some of the issues, input from the appointed valuer and the other experts comes in handy.

And since in reality they may not have been appointed during this second meeting, the issue of apportionment is usually postponed to the 3rd EOGM to ensure the method chosen is fair and acceptable to all the property owners.

There are 3 most common methods of yield distribution used by property sellers in Singapore, one of them being apportioning the proceeds depending on a person’s share value, and the other depending on the strata area of one’s property.

The third method is to use valuation. Valuation is commonly used in mixed development or commercial properties.

Incidentally, there is no rule prohibiting property owners from using more complex methods of distributing their sales proceeds among themselves, but many of them are actually not actively involved in the determination.

They are prepared to accept the method proposed by the CSC in liaison with the appointed experts.

Usually this is possible if their total agreement to sell collectively from the beginning, because then there is a high chance the group, through the CSC, will have appointed the property marketing agent and valuer, who would be helpful in setting a realistic price.

Factors that Help Determine Property Reserve Price

There are many factors that may come into play when property owners are setting the reserve price for their property, and here we shall list the most common ones:

- The site plot ratio as stipulated by the Urban Redevelopment Authority (URA)

- The existing built plot ratio

- If or not a site is to attract a development charge (DC), which is usually paid on account of the new developer intensifying the land use

- How far off the lease is from expiration date, because the closer it is the bigger the differential premium the new developer is bound to pay to top up the lease.

- The price level for similar properties recently sold in the neighbourhood

- The potential the site has for development

- The price trend for older properties in the neighbourhood

- Restricting factors, such as URA’s limitation of strata level, and likely future encroachment of the site by government institutions, which could force the owners to cede the land to the government.

- Prevailing overall cost of redevelopment, which includes labour cost.

- The behaviour of en bloc property prices, so that one can assess by how much prices of similar properties will have dropped or risen by the time the sales process is complete; the normal time taken being one and half years on the minimum.

On the overall, every cost that one can envision is taken into account, because it adds to the cost the potential developer will incur over and above the bid price.

That is why the owners of freehold property whose site is zoned residential can afford to set a higher reserve price than owners of similar property that is on leasehold that is halfway through.

It is important to note that developers cannot ignore the additional costs and wait to push them to the buyers of the new housing units, because those costs might make the house prices so high that they become unattractive.

Obviously, the longer a developer remains with unsold housing units the higher the risk of incurring taxes on them.

Due to all these considerations, many property owners give the CSC the mandate to set the reserve or asking price, in collaboration with the hired experts.

In many of the cases, therefore, the vast majority just ratify the CSC’s decision when they pass the resolution to sell at a given price during one of the extraordinary general meetings.

The appointed solicitor explained the terms and conditions of the CSA. Once approved in the EOGM, the consenting owners can start signing the CSA.

Step 3: Call for a 3rd EOGM

This is only necessary if the Method of Apportionment and the CSA are not approved or have not been approved in the previous EOGM.

Step 4: Obtaining minimum Consent

As we have discussed earlier the Collective Sales Committee has to work towards achieving minimum consent for the en bloc sale.

This is often considered to be the most challenging stage in a collective sales process and different interest groups have different opinions about the sales. As per the legal requirements the committee has to achieve –

- Minimum 80% consent for development that is more than 10 years old

- Minimum 90% consent for development that is less than 10 years old

You must keep in mind that the age of the property would be calculated from the day the TOP (Temporary Occupation Permit) was issued or CSC (Certificate of Statutory Completion) wherein TOP wasn’t issued.

The law also mandates the consent to be achieved within a time period of no more than 12 months from the date the first signature was recorded on the consent form.

Step 5: Launch for En Bloc Tender and Find Buyer

Once the minimum consent for the sale has been acquired, the marketing agents or the property consultants would put up the property for sale via a public tender.

During this stage the legal team shall draft all the required tender documents.

They would collaborate with the CSC to ensure all the terms and conditions are as per the expectations of the owners.

It is important to keep in mind that the sale would be as per all the legal requirements of the Strata Title Board. The highest bidder is usually awarded the bid for the property.

In case there are no bids at the tender stage the owners reserve the rights to enter into a private treaty with developers.

This process can take an additional 10 weeks or so. As per the law an interested buyer needs to be found within 12 months of obtaining the minimum consent from the owners wherein an application has been filed with the Strata Title Board.

Step 6: If Buyer is Found, Obtain Sales Order from STB

As we have mentioned earlier the Strata Title Board En Bloc (STB) is the vetting authority when it comes to en bloc sales if there is no 100% signatures.

If there is 100% signatures, STB approval is not necessary.

Once a buyer has been found the sale committee has to apply for a sales order with the STB.

In case there is an objection the sale the concerned parties may approach the High Court to stay the sale of the site. Here are some of the things CSC must prepare while applying for a sales order with the STB

- Agreement that has met minimum consent clause

- A statutory committee to represent the owners at the STB

- Valuation report of the development which shouldn’t be more than three months old

- Valuation should also state the formula for distribution of sales proceeds.

- Conditional sale and purchase agreement signed with the developer

- Ad that contains all the details concerning the sale published in local newspapers (approved by STB) in four official languages. The application must be submitted no more than 14 days from the publication of the ad.

- Owners or those who have interest in the estate who object to the sale and have not signed in the sale document can approach the Board against the sale

In case there are no objections filed with the Board the application would be approved unless the Board finds there is ambiguity in –

- sale price of the development

- the formula for the distribution of sales proceeds

- developer’s relationship with the owners

The Board can also reject applications when a disinterested party in the sale is made to be a part of the arrangement with the property’s redevelopment.

In usual cases of objection, the board usually calls for mediation (See Strata Title Board Mediation). However, if the Board is convinced that the disinterested party shall suffer financial losses due to the en bloc sale or receives a sum that is insufficient to meet mortgage payments the application shall be rejected.

What Happens If En Bloc Fails?

If no Buyer is found or the en bloc tender fails to attract any bids, the CSC has the option to enter private treaty with the developers.

They also can launch the property for sale again however it has to be done within the 12-month period.

After the expiry of the 12-month period is over, if the owners are eager to go for collective sale again, the whole en bloc process of gathering necessary consent has to be repeated.

Step 7: Legal Completion of the Sale

Once the relevant approvals have been received from the Strata Title Board or the High Court in case of any dispute the owners would can legally complete the sale and receive the proceeds of the sale (minus a small retention fee) from the developers.

Usually owners receive around 95% of the sales proceeds if they have agreed to a rent-free stay at the property for a grace period of 3-6 six months.

In case they agree to move out of the property immediately they can receive 100% of the sales proceeds. This process usually takes around 3 months

Step 8: Handover of the Property

This is the last stage in the process where you along with your fellow owners need vacate the property and hand it over to the developers.

As per the terms of the sale the owners or their tenants are usually given a time period of 3 to 6 months to vacate the property or make necessary arrangements with the owners.

If you have a tenancy agreement with your tenant that would legally end on the date no later than the date of possession you have signed with the developer as per the law by the Strata Title Board.

This law doesn’t clearly state any guidelines with respect to the tenant’s right to any compensation from the owners.

However, if property owners or lease holders haven’t given their consent to the sale agreement they can apply for compensation with the Board.

Once you have vacated the property the developers would release the remaining proceeds (in cases where applicable) of the sale within a time period of 10-15 days.

To sum up en bloc sales are a lucrative proposition in today’s market where developers are willing to match up to worthwhile reserve price to create large land banks.

With the demand for properties rising it is a great opportunity for property owners to get maximum value for their assets.

But you may have already understood the fact that en bloc sales are a long-drawn process and every stage requires time.

If you are planning to upgrade your lifestyle and get the most out of your property you along with your fellow property owners need to get started immediately.

As the realty experts say it is ‘once in a decade’ opportunity and you shouldn’t miss the enbloc Train.

Part 2: More about En Bloc Sales Process

Can Owners Object to an En Bloc Sale? Exploring Rights and Options

In the fast-paced real estate market of Singapore, en bloc sales often present lucrative opportunities for property redevelopment.

However, they also bring to the fore a critical question for many property owners: “Can we object to an en bloc sale?”

Here we explore the rights of owners in the en bloc process and the avenues available to them if they wish to contest a collective sale.

Understanding the En Bloc Sale Process

An en bloc sale is when multiple units of a property are sold collectively to a single buyer, typically for redevelopment.

While this can be financially rewarding, not all owners might be on board with the decision. Singapore’s legal framework around en bloc sales provides a structured process, but it also acknowledges the rights of dissenting owners.

Legal Thresholds for En Bloc Sales

For an en bloc sale to proceed, it must meet certain legal thresholds:

Objecting to an En Bloc Sale

Challenges in Objecting to an En Bloc Sale

While legal provisions exist for owners to object to an en bloc sale, it can be a challenging route:

Can owners object to an en bloc sale? Yes, they can. However, it requires a careful assessment of the situation, an understanding of legal rights, and preparedness for the potential challenges.

While the financial allure of en bloc sales is undeniable, it is crucial for owners to consider all aspects – legal, financial, and emotional – before making a decision.

Navigating the en bloc sale process with informed awareness can help owners make choices that align with their best interests.

What to Do If Neighbors Turn Hostile Over En Bloc Sale Disagreements

Dealing with a hostile environment in your en bloc development can be challenging, especially if you’re among the minority of owners who didn’t approve the sale.

Here are steps you can take to navigate this situation:

Navigating a hostile environment requires a balanced approach of open communication, understanding your rights, and seeking professional advice.

Remember that while you have a right to your opinion and decision regarding the en bloc sale, it’s also important to maintain respectful relations with your neighbors as much as possible.

My Property En Bloc Sale Ended in High Court, What To Do Next?

If the en bloc sale of your property has reached the High Court, it usually signifies the existence of disputes or objections that the Strata Titles Board (STB) process or other methods could not resolve.

Here’s a general guide to what you can do next:

Remember, legal processes can be complex, and the outcome of court cases can vary greatly depending on the specifics of each situation.

Therefore, it’s important to rely on professional legal advice and stay informed throughout the process.

How Long is the En Bloc Process?

It takes around one month for the first property owners introducing the idea of a collective sale to garner the necessary quorum to call an EOGM.

It then takes another one to two months to hold a second EOGM, during which the required professionals are appointed, including the property marketing agent.

Since the legal threshold of selling properties collectively has to be met for the sales to succeed, it takes another year to get the stipulated majority on board and to sign the CSA.

In short, it takes between three to fifteen months to accomplish the preliminaries of a collective sales process, before the public tender is launched.

After this there is another one to two months during which property owners meet to get updated on the progress and to discuss pertinent issues associated with the sale and that brings the timeline to four to seventeen months.

The month that follows is committed to the launch of the public tender, processing of the bids, closing of the tender, as well as awarding the tender to the successful bidder.

So, generally, a collective sales process ordinarily takes more than a year to 2 years from beginning to end.

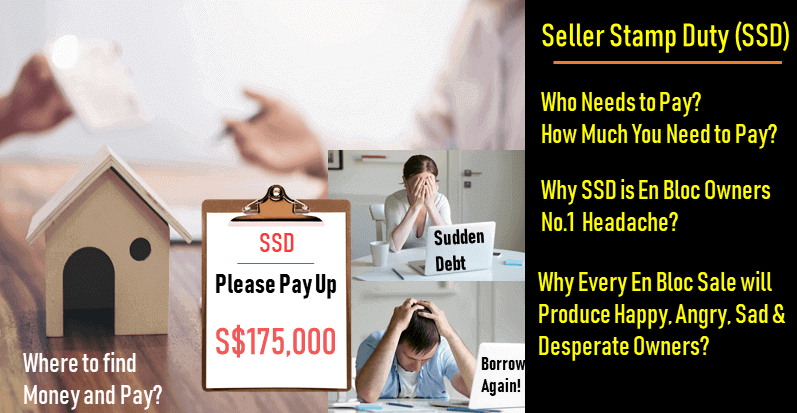

What is Seller Stamp Duty (SSD)

When property owners decide to sell their respective housing units en bloc, the greatest joy comes when a buyer is found who happens to offer a price that is lucrative for the sellers.

However, sometimes the apparently good news can stop certain sellers in their tracks, when letters from relevant authorities arrive demanding thousands of dollars as seller’s stamp duty (SSD), only a fortnight after revelling in the success of the sale.

Beginning March 2017, all home buyers have been required to pay a sizeable percentage of their property valuation as SSD, 12% for those selling within a year of buying the property, 8% for those selling within two years of buying, and 4% for those selling within three years of buying their housing unit.

This amount is significant when displayed in absolute figures, and it is painful for the homeowners to have to pay such huge amounts of money, probably for a sale they did not want in the first place.

Also, as some of the older homeowners at the development are celebrating, those who only recently acquired their properties are thrown into a new financial crisis.

It takes many months before they can see the money from the sale of their housing units, yet the government has shorter timelines within which a seller should pay the amount of SSD accruing from the sale.

Often the situation is exacerbated by the fact that the property sellers cannot borrow from the bank because they will normally have outstanding loans, in fact, pegged on the same properties that are now gone.

This means that besides lacking money to meet their SSD obligation, they also lack funds to secure themselves a new home.

It becomes like a case of someone whose life was shining and has all of a sudden been shattered by financial problems.

For those who choose to remain in their dwellings for a further six months as opposed to vacating immediately, they only receive part of their sales proceeds when everyone else is receiving theirs and they only receive the balance after they have vacated the property.

Who Needs to Pay SSD?

For those who bought and sell their properties within 4 years

See the table below

(Mobile User Scroll to the Right)

| Holding Period | March 11, 2017 to July 3, 2025 | From July 4, 2025 Onwards |

|---|---|---|

| Up to 1 yr | 12% | 16% |

| Up to 1 yr to 2 yr | 8% | 12% |

| Up to 2 yr to 3 yr | 4% | 8% |

| Up to 3 yr to 4 yr | No SSD Payable | 4% |

| More than 4 yrs | No SSD Payable | No SSD Payable |

What is PAFS URA?

PAFS stands for Pre-Application Feasibility Study, which is supposed to be carried out before a development application can be submitted to the URA.

The circular introducing PAFS was released in November 13, 2017 by the URA, following concerns of potential congestion on roads and residential areas as a result of intensified redevelopment of older constructions.

Once developer has acquired a en bloc site, they will try to redevelop and build their new project as many units as possible. Usually 2 to 3 times more.

If there is no restriction, it may result traffic congestion everywhere thus actions has to be taken.

Why URA needs to implement PAFS?

URA was keen on getting the information on PAFS to everyone concerned with establishment of residential properties and their occupation, including property owners, developers and architects, as well as real estate agents.

This regulatory body also wanted traffic and transport consultants to be in the know.

This is because since the en bloc sales wave began in 2017, it has become clear that areas that were initially serene and sparsely populated are likely to become chaotic and congested in due course and traffic jams might soon become a big issue.

There is also the risk of social amenities and other services being overstretched beyond capacity.

The fear by the URA emanates from the fact that many developers are intent on increasing the number of housing units once they have acquired the sites through en bloc sales, sometimes doubling or tripling them from the initial number.

The importance of introducing PAFS is to ensure that experts working with the CSCs, such as the real estate agents, conduct feasibility studies with a view to establishing the impact the intended development is bound to have on traffic along the roads within the area.

If a site that had a condo with 50 families is going to hold a development with 180 families, clearly there is bound to be a much larger number of cars as people drive to and from work, and more vehicles dropping children to and from school.

Since authorities in Singapore have always preferred to have residential areas that are healthy and comfortable and transport systems that are free from the menace of traffic jams, the URA decided to be proactive in ensuring the peaceful environment persists even amid increased housing redevelopments.

In the event that the agencies conducting the PAFS realize the proposed redevelopment is likely to destabilize the peaceful existence of people within the area, they have been charged with the duty of proposing measures to avert such a negative impact.

The completed PAFS are then to be submitted to the Land Transport Authority (LTA), so that the PAFS can be evaluated by the body that knows for certain how the roads are and the factors likely to affect them adversely.

Only after the PAFS have been approved by the LTA can the agencies concerned proceed to submit necessary applications to the URA for redevelopment of the proposed site.

In short, URA can now only approve the number of development units that LTA certifies to be acceptable.