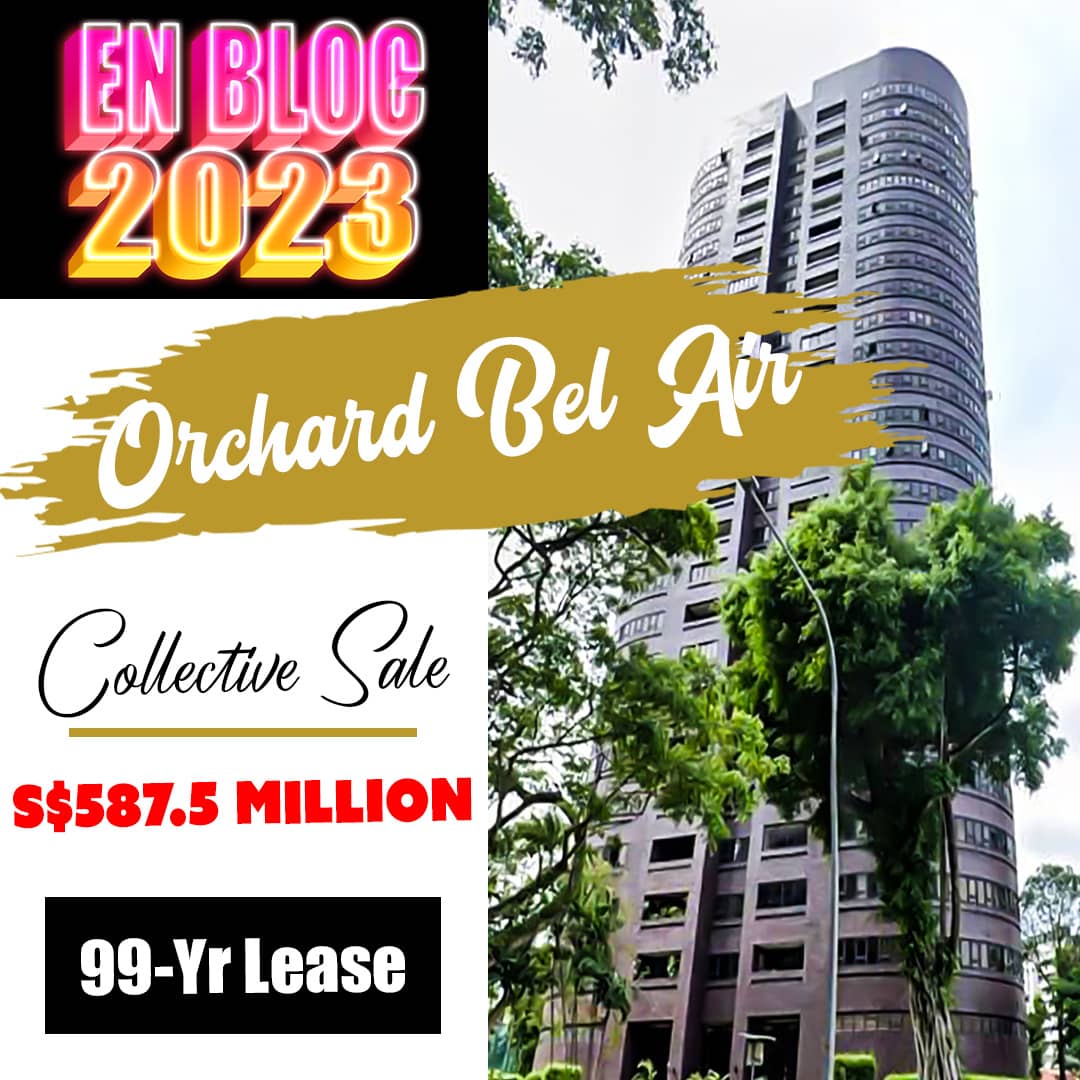

Orchard Bel Air En Bloc Sale Relaunched in 2023 – Prime D10 (CCR)

On Tuesday, January 31, Orchard Bel Air, a residential development in Prime District 10, was launched for collective sale at an unchanged reserve price of S$587.5 million.

It is understood that the last effort, which ended on September 6 of last year, was unsuccessful.

The 99-year leasehold condominium, whose lease began in August 1980, is situated near the recently completed Orchard Boulevard MRT station. It was first listed for sale on July 27, 2022.

According to the Master Plan 2019, Orchard Bel Air has a land area of about 93,126 square feet (sq ft), a gross plot ratio (GPR) of 2.8, and a building height restriction of up to 36 storeys. It might be rebuilt up to its confirmed gross floor area, which is now about 276,298 square feet at a GPR of 2.96.

According to marketing agency Knight Frank, after accounting for an upgrade premium of roughly S$136 million for the lease top-up, its reserve price corresponds to a land rate of around S$2,620 psf ppr. This equates to around S$2,551 psf ppr when taking into account the 7% bonus gross floor area permitted for balconies.

It further said that, depending on plan and configuration and subject to clearance from the authorities, an estimated 128 additional residential units with an average 2,153 sq ft might be built on the prime site.

They also stated that there would be no need for a pre-application feasibility study on traffic impact.

Orchard Bel Air, which has 25 floors and 71 residential flats, was built in 1984. Nearby are high-end apartments, hotels, places of work, and shopping malls like Tanglin Mall, Ion Orchard, and The Forum.

The development’s “excellent position” affords unhindered panoramic views of the metropolis, according to Chia Mein Mein, at Knight Frank.

This makes it one of the few redevelopment sites available for sale in the land-scarce Orchard area.

Within this premium enclave, she said, “There may not be another residential redevelopment site out for sale in the foreseeable future.” Particularly now, when owners’ worries about replacement costs make it difficult to get a mandate in any en bloc process.

Rich Buyers Are Coming to Singapore, Luxury Homes in High Demand

According to Knight Frank, the opening of international borders caused a surge in demand for luxury homes in Singapore.

Nine apartments have been sold for between S$4,400 and S$4,900 per square foot at the neighbouring Park Nova since the third quarter of 2022, with the project attaining about 87 percent sales.

In December 2022, a 2,799 sq ft apartment at Boulevard 88 on Orchard Boulevard was sold for S$13.78 million, or S$4,924 per square foot.

Les Maisons Nassim, meanwhile, recently witnessed four purchases with prices ranging from S$5,296 to S$6,057 psf, or between S$36 million and S$68 million. Currently, over 79% of the units in the complex are sold.

“The flight of private wealth to the safe haven sanctuary that Singapore represents,” said Chia, “stands to benefit the high-end residential market, which has not experienced as much price growth in the last two years when compared to suburban homes.”

Chia added that this is especially true for family-sized luxury homes in the center of Orchard Road.

The tender for the Orchard Bel Air en bloc site will close at 3 p.m. on March 1, 2023.